Investment opportunity results from:

- Investor reaction to stress (macro or company).

- Overreaction reflects emotion and behavioral biases such as loss aversion and need for certainty.

- Overreaction fails to distinguish stress as temporary versus structural.

Investment success results from:

- Identifying, understanding and measuring the opportunity.

- Using rigorous process devoid of bias.

This works because:

- Investor overreaction creates market anomalies.

- Temporary stress disproportionately impacts valuations.

- That temporary nature allows the purchase of good companies at discounts.

- As conditions normalize over time, valuations recover.

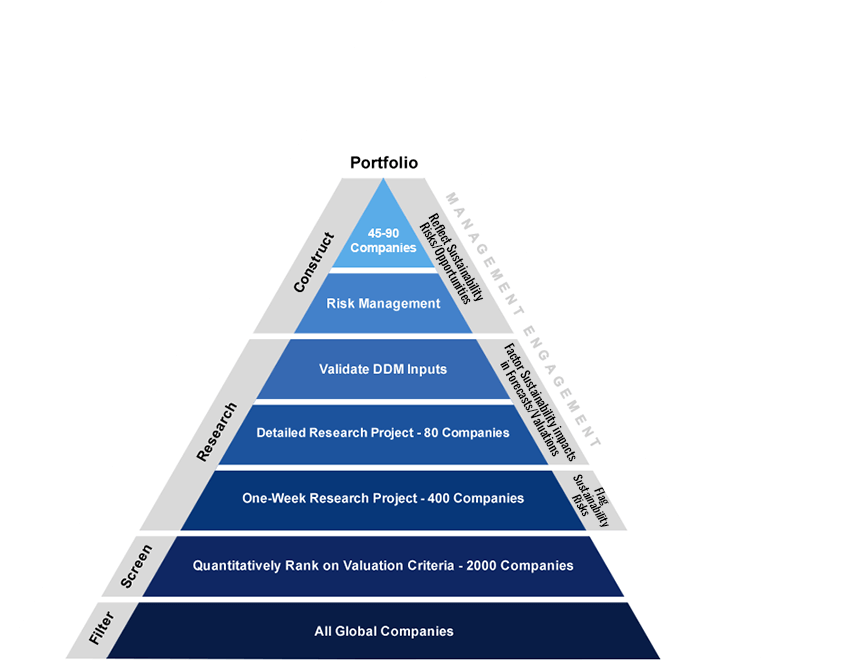

As a classic value manager, ARGA owns deeply undervalued securities with substantial upside. Our investment approach is based on fundamental research and present value using our Dividend Discount Model (DDM).

- Stock screens identify potentially undervalued businesses.

- DDM measures undervaluation for base and stress cases.

- Consistent industry and company analysis drives DDM inputs.

- We adjust for company quality and economic risks.

Research drives ARGA’s investment process, decisions and execution. The Research Team is comprised of Global Business Analysts in both developed and emerging markets. Research expertise includes:

- Long-term experience and team cohesiveness

- Consistent application of our systematic valuation framework

- Industry expertise captured in Global Industry Models

- Use of technology to leverage global insights

- Valuation focus across multiple strategies

ARGA implements our valuation-based approach using a rigorous, systematic process. Representative steps include:

- Build industry and company models

- Evaluate sustainability

- Assess companies’ long-term earnings power

- Develop company-specific forecasts and DDM inputs

- Manage risk through stress tests

ARGA has developed technology to enhance research efficiency and effectiveness. ARGA’s Data Management System applies ARGA’s institutional knowledge across industries, geographies and strategies. ARGA’s Global Industry Models apply proprietary relationships to:

- Systematize our valuation process

- Evaluate assumptions, trends and sustainability

- Ensure consistency in industry variables and accounting

- Compare company forecasts and valuations

Sustainability supports our valuation framework:

- We seek companies with issues that may temporarily depress valuations

- ARGA Sustainability Scoring Framework – flags and measures sustainability risks/opportunities

- Stakeholder engagements address issues

- Dedicated Head of Sustainability

- Signatory of United Nations Principles for Responsible Investment (UNPRI)